kctt.spb.ru

Learn

Stock Broker Account Online

An online brokerage account allows you to easily transfer available funds between your Bank of America bank and Merrill investment accounts. Access Direct is an online, self-directed brokerage account which means you can do things like buy or sell mutual funds, ETFs, or other stock and help you. For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. By Phone. Call By Mail. Zerodha - India's biggest stock broker offering the lowest, cheapest brokerage rates for futures and options, commodity trading, equity and mutual funds. A WellsTrade account offered by Wells Fargo Advisors opened online comes with Brokerage Cash Services, which give you convenient money-movement options. A brokerage account is a non-retirement investment account that lets you buy and sell securities like stocks, bonds, mutual funds and ETFs. You can deposit as. Buy, sell, and trade stocks online with a brokerage account from Wells Fargo Advisors WellsTrade. DEGIRO is Europe's fastest growing online stock broker. DEGIRO distinguishes itself from its competitors by offering extremely low trading commissions. The top online brokerage accounts for trading stocks in September · Charles Schwab · Fidelity Investments · Robinhood · E-Trade · Interactive Brokers. An online brokerage account allows you to easily transfer available funds between your Bank of America bank and Merrill investment accounts. Access Direct is an online, self-directed brokerage account which means you can do things like buy or sell mutual funds, ETFs, or other stock and help you. For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. By Phone. Call By Mail. Zerodha - India's biggest stock broker offering the lowest, cheapest brokerage rates for futures and options, commodity trading, equity and mutual funds. A WellsTrade account offered by Wells Fargo Advisors opened online comes with Brokerage Cash Services, which give you convenient money-movement options. A brokerage account is a non-retirement investment account that lets you buy and sell securities like stocks, bonds, mutual funds and ETFs. You can deposit as. Buy, sell, and trade stocks online with a brokerage account from Wells Fargo Advisors WellsTrade. DEGIRO is Europe's fastest growing online stock broker. DEGIRO distinguishes itself from its competitors by offering extremely low trading commissions. The top online brokerage accounts for trading stocks in September · Charles Schwab · Fidelity Investments · Robinhood · E-Trade · Interactive Brokers.

A margin account allows you to borrow money from a brokerage firm to buy securities. This is also the only type of account in which investors can engage in. What we offer. Buy stocks, exchange traded funds (ETFs) and options online or with the TIAA mobile app for $0 per trade. Brokerage account. Investing and trading account. Buy and sell stocks, ETFs, mutual funds, options, bonds, and more. Learn. These types of accounts are designed to allow individuals to invest in the stock market Find the right one for you on our list of the best online brokerages. Open a brokerage account. Reasons to consider The Fidelity Account. Wide range of investment choices. $0 commission for online US stock, ETF, and option trades. Get up to $ Unlimited commission-free 1 online trades When you open and fund a JP Morgan Self-Directed Investing account (retirement or general) with. Online trading should be easy. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services (we offer them commission-free online) or through. Bankrate analyzed dozens of brokerage firms to help you find the best online brokers for stocks. Here are our top picks for the best online stock brokers. A brokerage account gives you access to the stock market, allowing you to buy online brokers like Ally Invest. Brokers essentially act as middlemen. It's a great option if you want to invest in the stock market to work Pay no trade minimums, no account minimums and $0 online listed equity trades. Online trading of brokerage products--stocks, ETFs, CDs, and bonds--is simple in a Vanguard Brokerage Account. Here are the best online brokerage accounts and trading platforms with low costs and fees plus the best trading experience, mobile apps, and more. E*TRADE from Morgan Stanley charges $0 commission for online US-listed stock, ETF, mutual fund, and options trades. Exclusions may apply and E*TRADE from Morgan. Brokerage Plus. For clients who like flexibility when it comes to managing investments – plus the convenience of independent, online trading. Access. Start investing online with SoFi. Enjoy commission-free trades and access to stock trading, options, auto investing, IRAs, and more. Start with just $5. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Open a free Demat Account online with kctt.spb.ru and enjoy ₹ 0 brokerage for life on equity trading, mutual funds, and more. No demat account charges! Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Commission-free online trades apply to trading in U.S.-listed stocks, exchange-traded funds (ETFs) and options. Options trades are subject to a $ per-. Other fees and commissions apply to a WellsTrade account. Schedule subject to change at any time. 2Online Extended Hours Trading Risk Disclosures. 3Terms and.

Cut Buddy Tool

Cut Buddy Beard Shaping Tool use with pencil. Perfect Tool for Those Who Struggle With Haircut Shaping and Lining Up: Includes 1 pencil. Get The Cut Buddy Shaping Guide Tool, Hairline and Beard delivered to you in as fast as 1 hour via Instacart or choose curbside or in-store pickup. The Cut Buddy is designed to make trimming and cleaning up your own beard simple and can be used for beard shaping, hair trims, mustache styling, neck saving. Use The Cut Buddy as a guide to reduce errors and mistakes on your beard, haircut, or mustache so you can feel great about how you look. The Cut Buddy Plus Perfect Hair & Beard Shaping Tool. The Cut Buddy. Category: Hair Styling Tools. SKU: (No Review Yet). Minimum Purchase Quantity. As Seen on Shark Tank! The Perfect Tool for Those Who Struggle with Facial Hair Grooming, From Beards to Sideburns. The Cut Buddy | Trim Buddy - Trimmer + Shaper Combo for Men | Free Shaping Tool | Battery-Powered - Trial Size · The Cut Buddy · out of 5 stars with The Cut Buddy - Beard Shaping Tool, Hair Trimmer Guide, Men's Beard Template Tool, Goatee Liner, Mustache Styling Shaper, Neck Shave Grooming Guide. This innovative tool is designed to help you achieve clean and symmetrical lines with ease, whether you're using a trimmer or a razor. The clear guide allows. Cut Buddy Beard Shaping Tool use with pencil. Perfect Tool for Those Who Struggle With Haircut Shaping and Lining Up: Includes 1 pencil. Get The Cut Buddy Shaping Guide Tool, Hairline and Beard delivered to you in as fast as 1 hour via Instacart or choose curbside or in-store pickup. The Cut Buddy is designed to make trimming and cleaning up your own beard simple and can be used for beard shaping, hair trims, mustache styling, neck saving. Use The Cut Buddy as a guide to reduce errors and mistakes on your beard, haircut, or mustache so you can feel great about how you look. The Cut Buddy Plus Perfect Hair & Beard Shaping Tool. The Cut Buddy. Category: Hair Styling Tools. SKU: (No Review Yet). Minimum Purchase Quantity. As Seen on Shark Tank! The Perfect Tool for Those Who Struggle with Facial Hair Grooming, From Beards to Sideburns. The Cut Buddy | Trim Buddy - Trimmer + Shaper Combo for Men | Free Shaping Tool | Battery-Powered - Trial Size · The Cut Buddy · out of 5 stars with The Cut Buddy - Beard Shaping Tool, Hair Trimmer Guide, Men's Beard Template Tool, Goatee Liner, Mustache Styling Shaper, Neck Shave Grooming Guide. This innovative tool is designed to help you achieve clean and symmetrical lines with ease, whether you're using a trimmer or a razor. The clear guide allows.

The Cut Buddy - As Seen On Shark Tank - Beard Shaping Tool, Hair Trimmer Guide, Men's Beard Template Tool, Goatee Liner, Mustache Styling Shaper. Trim Buddy Trimmer and Shaping tool Tutorials. The Cut Buddy. 35 videosLast updated on Jan 11, Hair Cutting and Beard Shaping Tool With Barber Lining Pencil Multiple Curves - Curve Sizes/Angles instead of just 1! Don't limit yourself to one curve. Hair and beard shaping tool. Availability: In stock SKU: Category: Beard Care Brand: Andis. - +. Add to cart. Compare · Facebook Twitter LinkedIn. The Cut Buddy is a premium hair and beard shaping tool. Create beard and facial hair lines for flawless at-home trims. The Cut Buddy | Hairline and Beard Edge Up Shaping Tool and Hair Trimmer. The Cut Buddy TCB Beard Shapping Tool *Note: All pictures shown are for illustration purposes only. Actual product may vary due to product enhancement. Related. Master your style with Andis Cut Buddy Hair & Beard Shaping Tool. Versatile curves and angles for all head sizes, durable for precise beard and hair cuts. The Cut Buddy trimming template tool works in conjunction with hair clippers, hair fiber, detailers, outliners, disposable razors or a straight razor. The. Anyone know a good tool to line up the hair corner? Maybe something like the cut buddy. The Cut Buddy; Beard Shaping Tool and Hair Trimmer Guide - Plus. + Follow. Home · Shave Buddy · The Spot · Bald Buddy - Ergonomic Bald Shaver · 35 Piece Clipper. The Cut Buddy trimming template tool works in conjunction with hair clippers, trimmer, detailers, outliners, disposable razors or a straight razor. With a quick. Use The Cut Buddy as a guide to reduce errors and mistakes on your beard, haircut, or mustache so you can feel great about how you look. Say goodbye to uneven lines and bald spots with the incredible Cut Buddy. This is the ultimate grooming tool every man needs in his arsenal. Get ready to level. Hairline and Beard Shaping Guide Tool. Shaping tool helps maintain your style between visits to the barber Use curves to define your sideburns and beard. The Cut Buddy - as seen on Shark Tank - beard shaping tool, hair trimmer guide, goatee liner, mustache styling, & neck grooming guide. It does it all. Cut Buddy Hair & Beard Shaping Tool. Andis SKU: AND THE CUT BUDDY PERFECT HAIR AND BEARD SHAPING TOOL Perfect Hair and Beard Shaping Tool Bonus!: Free Speed Tracer Pencil Inside. Ask a question. Andis The Cut Buddy – Hairline and Beard Shaping Tool Use The Cut Buddy as a guide to reduce errors and mistakes on your beard, haircut, or mustache so you.

Oil Producer Etf

Unlike other commodity ETFs that can buy the asset and hold it physically, Oil ETFs are based on futures contracts. This means they do not actually track the. The two popular crude oil ETFs are the United States 12 Month Oil Fund (USL) and the United States Oil Fund (USO). Both ETFs are issued by the United States. List of Top Performing Oil & Gas ETFs in ; USO · United States Oil Fund, % ; BNO · United States Brent Oil Fund, % ; OILK · ProShares K-1 Free Crude. The Texas Capital Texas Oil Index ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the total return. Passively managed, using a full-replication strategy when possible and a sampling strategy if regulatory constraints dictate. Includes stocks of companies. E.T.F.s focused on companies with smaller carbon footprints. Funds Investing in coal companies, oil/gas producers, and coal-fired utilities isn. The Oil ETF by VanEck invests in companies active in the upstream oil sector. The portfolio comprises 25 US listed players who are classified as oil service. XOP Analysis & Insights. XOP tracks an equal-weighted index of companies in the US oil & gas exploration & production space. XOP offers an equal-weighted. Oil & Gas ETFs invest directly in oil or gas and/or their subsidiary commodities. Note that these funds almost always utilize futures exposure. Unlike other commodity ETFs that can buy the asset and hold it physically, Oil ETFs are based on futures contracts. This means they do not actually track the. The two popular crude oil ETFs are the United States 12 Month Oil Fund (USL) and the United States Oil Fund (USO). Both ETFs are issued by the United States. List of Top Performing Oil & Gas ETFs in ; USO · United States Oil Fund, % ; BNO · United States Brent Oil Fund, % ; OILK · ProShares K-1 Free Crude. The Texas Capital Texas Oil Index ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the total return. Passively managed, using a full-replication strategy when possible and a sampling strategy if regulatory constraints dictate. Includes stocks of companies. E.T.F.s focused on companies with smaller carbon footprints. Funds Investing in coal companies, oil/gas producers, and coal-fired utilities isn. The Oil ETF by VanEck invests in companies active in the upstream oil sector. The portfolio comprises 25 US listed players who are classified as oil service. XOP Analysis & Insights. XOP tracks an equal-weighted index of companies in the US oil & gas exploration & production space. XOP offers an equal-weighted. Oil & Gas ETFs invest directly in oil or gas and/or their subsidiary commodities. Note that these funds almost always utilize futures exposure.

The two popular crude oil ETFs are the United States 12 Month Oil Fund (USL) and the United States Oil Fund (USO). Both ETFs are issued by the United States. The S&P Oil & Gas Exploration & Production Select Industry Index (SPSIOPTR) is provided by Standard & Poor's Index Provider and includes domestic companies from. This ProShares ETF seeks daily investment results that correspond, before companies are located or do business, and risks for environmental damage claims. OIH - Overview, Holdings & Performance. The index seeks to track the largest, most liquid companies in the oil industry based on market capitalization and. The SPDR® S&P® Oil & Gas Exploration & Production ETF seeks to provide investment results that, before fees and expenses, correspond generally to the. The Index is composed of securities of 30 U.S. companies involved in the exploration and production of natural resources used to produce energy. These companies. The Fund seeks to track the performance of an index composed of global companies involved in the exploration and production of oil and gas. Find the latest quotes for iShares U.S. Oil & Gas Exploration & Production ETF (IEO) as well as ETF details, charts and news at kctt.spb.ru The S&P Oil & Gas Exploration & Production Select Industry Index (SPSIOPTR) is provided by Standard & Poor's Index Provider and includes domestic companies from. Select Oil Exploration & Production Index composed of U.S. equities in the oil and gas exploration and production sector. USO · United States Oil Fund LP, $1,, ; UNG · United States Natural Gas Fund LP, $, ; BNO · United States Brent Oil Fund LP, $, ; DBO · Invesco. SPDR S&P Oil & Gas Exploration & Production ETF ; Price at close. $ % ; Key Fund Data. Net Assets. $B · 52 Wk Range. - Yield. The return on the MicroSectors™ Oil & Gas Exploration & Production 3X Leveraged ETNs (3X ETNs) is linked to a three times leveraged participation in the. This ProShares ETF seeks daily investment results that correspond, before companies are located or do business, and risks for environmental damage claims. XOP ETF in-depth analysis and real-time data such as the investment strategy, characteristics, ETF Facts, price, exposure, AuM, Expense Ratio, and more. Find the latest iShares U.S. Oil & Gas Exploration & Production ETF (IEO) stock quote, history, news and other vital information to help you with your stock. iShares U.S. Oil & Gas Exploration & Production ETF is an exchange-traded fund incorporated in the USA. The ETF tracks the Dow Jones US Select Oil Exploration &. Passively managed, using a full-replication strategy when possible and a sampling strategy if regulatory constraints dictate. Includes stocks of companies. Latest iShares U.S. Oil & Gas Exploration & Production ETF (IEO:BTQ:USD) share price with interactive charts, historical prices, comparative analysis.

Managing Working Capital

:max_bytes(150000):strip_icc()/workingcapitalmanagement_definition_0914-38bc0aea642a4a589c26fbc69ea16564.jpg)

Liquidity ratio: Working capital can also be assessed using the current ratio (working capital ratio). It is a measure of liquidity, meaning the business's. Learn how managing working capital successfully enables you to distinguish different types and sources of short-term financing. Working capital management allows organizations to maintain cash flows and lets them meet short-term targets, while also factoring in unexpected costs and. A deficit in working capital can mean you lose out on growth and new business opportunities. Cashflow disruption that impacts operations was the primary concern. It involves the efficient management of current assets and liabilities to ensure sufficient liquidity for ongoing operations. The primary objectives of working. Working capital comprises four key components: cash, accounts receivable, inventory, and accounts payable. Is there a difference between working capital and net. Working capital management is a business strategy that involves optimizing your ratio of assets to liabilities to suit your unique business needs. Working capital is the difference between an organization's current assets and its current liabilities. Also referred to as net working capital. In this guide, we cover the importance of working capital, how to determine working capital, and what is a good working capital ratio. Liquidity ratio: Working capital can also be assessed using the current ratio (working capital ratio). It is a measure of liquidity, meaning the business's. Learn how managing working capital successfully enables you to distinguish different types and sources of short-term financing. Working capital management allows organizations to maintain cash flows and lets them meet short-term targets, while also factoring in unexpected costs and. A deficit in working capital can mean you lose out on growth and new business opportunities. Cashflow disruption that impacts operations was the primary concern. It involves the efficient management of current assets and liabilities to ensure sufficient liquidity for ongoing operations. The primary objectives of working. Working capital comprises four key components: cash, accounts receivable, inventory, and accounts payable. Is there a difference between working capital and net. Working capital management is a business strategy that involves optimizing your ratio of assets to liabilities to suit your unique business needs. Working capital is the difference between an organization's current assets and its current liabilities. Also referred to as net working capital. In this guide, we cover the importance of working capital, how to determine working capital, and what is a good working capital ratio.

There are five main levers to working capital, which if kept in check could help take a business to the next level. Working capital is an important metric that gives you an idea of your operational efficiency, short-term financial health and how liquid your business is. Working capital Approaches: A) Matching or hedging approach: This approach matches assets and liabilities to maturities. Basically, a company uses long term. Working capital management refers to the various tactics a business entity employs to regulate its current assets and current liabilities to attain working. Working capital management is the strategic deployment of cash to achieve this balance and maintain healthy asset/liability ratios. Using working capital. Working capital management refers to the various tactics a business entity employs to regulate its current assets and current liabilities to attain working. The management of working capital includes the management of current assets and current liabilities. A number of companies for the past few years have been. The simplest formula for improving the working capital position is to collect receivables early and slow down the payables. This is, of course, easier said than. These five techniques for working capital management will help you improve how cash flows in and out of your business, control costs, and collect your income. Working Capital Management in Treasury is short-term financial planning. It is defined as a company's current assets minus its current liabilities. Working capital management analyzes and optimizes the relationship between current assets and current liabilities to operate a business effectively. The net. Why Is Efficient Working Capital Management Important? · Operational Efficiency: Adequate working capital ensures the smooth functioning of daily operations. Good working capital management is essential to maintaining liquidity and profitability, not to mention the coverage of cash-flow. 15 working capital management best practices for startups · Fuel day-to-day operations · Support expansion and scale · Build a financial safety net · 1. Manage. Working capital management is a business strategy that helps companies monitor and use their current assets and liabilities. Current assets are anything that a. This article has covered the foundations of working capital management, focusing on the analysis of current assets and current liabilities. The formula to calculate working capital—at its simplest—equals the difference between current assets and current liabilities. Working Capital = Current Assets. We help companies apply proven business best practices to transform the end-to-end processes that influence effective cash flow management. Managing your working capital more effectively can help improve your business' overall financial health. By managing your working capital effectively, you. A management strategy is a plan to improve the processes, streamlining the cash flow in a way that suits the business's short-term and long-term goals.

Beginner Day Trading Platform

Tastyworks is known for its low fees, advanced options trading platform, and fast trade execution. It's a great platform for beginner traders just starting out. The Best Day Trading Platforms For Beginners in ; Trade Ideas. stars · Stock Scanning & Charing ; Jigsaw Trading. stars · Order book trading resource. What are the Best Day Trading Platforms for Beginners? · 1. Thinkorswim Trading Platform · 2. Ninja Trader Trading Platform · 3. TradeStation Trading Platform. Day Trading Brokers · Day Trading Hardware, Software and Tools · Risk, Account & Money Management · Day Trading Strategies · Day Trading Basics · DAS Trader Pro Tips. Interactive Brokers is the best online broker for day trading, with a wide range of assets, excellent trading technology, and low margin rates. Trading platforms like eTrade and Robinhood and charting software like Webull and Market Trader provide real-time market data, advanced charting features, and. Plan your entry and exit points in advance and stick to the plan. Identify patterns in the trading activities of your choices in advance. Day traders use many. Yes, just look for a trading platform that offers the chance to carry out trading using a demo account. First and foremost, learn how to day trade using virtual. Merrill Edge is another solid broker for frequent traders thanks to its low commissions and high-powered trading platform. Like most other brokers, stock and. Tastyworks is known for its low fees, advanced options trading platform, and fast trade execution. It's a great platform for beginner traders just starting out. The Best Day Trading Platforms For Beginners in ; Trade Ideas. stars · Stock Scanning & Charing ; Jigsaw Trading. stars · Order book trading resource. What are the Best Day Trading Platforms for Beginners? · 1. Thinkorswim Trading Platform · 2. Ninja Trader Trading Platform · 3. TradeStation Trading Platform. Day Trading Brokers · Day Trading Hardware, Software and Tools · Risk, Account & Money Management · Day Trading Strategies · Day Trading Basics · DAS Trader Pro Tips. Interactive Brokers is the best online broker for day trading, with a wide range of assets, excellent trading technology, and low margin rates. Trading platforms like eTrade and Robinhood and charting software like Webull and Market Trader provide real-time market data, advanced charting features, and. Plan your entry and exit points in advance and stick to the plan. Identify patterns in the trading activities of your choices in advance. Day traders use many. Yes, just look for a trading platform that offers the chance to carry out trading using a demo account. First and foremost, learn how to day trade using virtual. Merrill Edge is another solid broker for frequent traders thanks to its low commissions and high-powered trading platform. Like most other brokers, stock and.

We often use the NinjaTrader trading platform to trade futures markets. The E-mini is considered a futures market, as traders buy and sell the market according. Robinhood is an excellent choice for beginners because the platform is easy to use, with one of the best user interfaces in the industry. Therefore, new. Day Trading Strategies for Beginners · What Is Day Trading? Day trading is the opening and closing of your trading positions within a short period, typically the. Right now the best crypto day trading exchange in the USA is BYDFi since it is regulatedd in the region. This is one of the few pitfalls of Binance. Platform. The best day trading platform for beginners is an easy-to-use platform. This is essential for beginners to gain confidence and navigate the complexities of day. Plan your entry and exit points in advance and stick to the plan. Identify patterns in the trading activities of your choices in advance. Day traders use many. Robinhood: Robinhood is a platform that offers commission-free stock trading, which makes it great for beginners who want to avoid incurring significant. The Firstrade web-trading platform comes with an intuitive U.I. design which helps beginner traders get a comprehensive overview of all the crucial data and. Derivates, such as CFDs and spread bets, let you day trade without owning the underlying asset, which could be ideal for you as a beginner. You can close or. A day trading platform is the technology used to facilitate the trade of financial instruments, enabling positions to be opened and closed within a single day. Webull: Best for overall day trading. · Fidelity: Best for trading costs. · Interactive Brokers: Best for investment offerings. · E*Trade from Morgan Stanley: Best. Day Trading Software · Online Broker: Lightspeed Financial Broker · Stock Scanning Software: Warrior Trading Scanners · Charting Software: Warrior Charts · Final. Margin account – This type of account allows you to borrow money from your broker. This will enable you to bolster your potential profits, but also comes with. CIBC Investor's Edge is one of the best day trading platforms for beginners in Canada. This bank-owned discount broker can be used to day trade stocks and. Best for leveraged day trading and multiple account types. Lightspeed is a premier broker that caters to day traders of stocks, options, ETFs, and futures. We'll explore the top 10 best day trading platforms for beginners, highlighting their features, pros, and cons to help you make an informed decision. There's no short cut to investment success, and the first thing for any beginner is to educate oneself until one is adequately prepared to do real trading. SelfWealth: A low-cost brokerage platform that offers flat-fee trading on Australian shares. It features a social trading network that allows day traders to. What is the best Canadian trading platform for beginners? Questrade is a good choice for beginners as you have the option to use their Questwealth Portfolios. Yes, just look for a trading platform that offers the chance to carry out trading using a demo account. First and foremost, learn how to day trade using virtual.

Where Can I Get 6 Return On My Money

Most smart investors put enough money in a savings product to cover an emergency, like sudden unemployment. Some make sure they have up to six months of their. But after building three to six months of easy-to-access savings Return is the amount of money you earn on the assets you've invested, or the. Safe assets such as US Treasury securities, high-yield savings accounts, money market funds, and certain types of bonds and annuities offer a lower risk. For those looking to take less risk in their portfolios, traditionally safer investments include treasury bonds, money market funds, and “blue chip” stocks that. Amount of money that you have available to invest initially. Step 2: Contribute. Monthly Contribution. Amount that you plan to add to the principal every month. their portfolios and not put all their funds into one high-return investment. the bonds while the inflation rate is adjusted every six months. Cashing. It pays a fixed interest rate for a specified amount of time, giving an easy-to-determine rate of return and investment length. Normally, the longer that money. the prior principal and the interest earned in the previous 6 months. With a Series I savings bond, you wait to get all the money until you cash in the bond. kctt.spb.ru provides a FREE return on investment calculator and other ROI calculators to compare the impact of taxes on your investments. Most smart investors put enough money in a savings product to cover an emergency, like sudden unemployment. Some make sure they have up to six months of their. But after building three to six months of easy-to-access savings Return is the amount of money you earn on the assets you've invested, or the. Safe assets such as US Treasury securities, high-yield savings accounts, money market funds, and certain types of bonds and annuities offer a lower risk. For those looking to take less risk in their portfolios, traditionally safer investments include treasury bonds, money market funds, and “blue chip” stocks that. Amount of money that you have available to invest initially. Step 2: Contribute. Monthly Contribution. Amount that you plan to add to the principal every month. their portfolios and not put all their funds into one high-return investment. the bonds while the inflation rate is adjusted every six months. Cashing. It pays a fixed interest rate for a specified amount of time, giving an easy-to-determine rate of return and investment length. Normally, the longer that money. the prior principal and the interest earned in the previous 6 months. With a Series I savings bond, you wait to get all the money until you cash in the bond. kctt.spb.ru provides a FREE return on investment calculator and other ROI calculators to compare the impact of taxes on your investments.

the money withdrawn. If you withdraw $40,, and have Source: Charles Schwab Investment Management's (CSIM) year long-term return estimates. Customers with automated deposits earned 6% higher annual returns than those that did not. Based on Betterment's internal calculations for the Core portfolio. To be considered, the alleged act resulting in a claim must have taken place within the past six years. the customer's cash and securities are returned. The filters you have chosen return no matching results. Please try changing your filter selections or reset all filters. Disclosures. Some make sure they have up to six months of their income in savings so The company promises to return money plus interest. Risk: The company may do. " Simply divide 72 by the expected rate of return. For example, if your investments returned 6% annually, you would double your investment about every 12 years. How it generates a return and the type of return expected (capital gain or income). Six steps to get ready to invest. 5 min read · Diversification. Spread. returns on your money if you invest with them. They say you're guaranteed to make money off the investment. Often these investments aren't real, or they're. Hold the money in a relatively safe, liquid account, such as an interest-bearing bank account or money market fund. With this cash on hand, you won't have to. The average investor who doesn't have a lot of time to devote to financial management can probably get away with a few low-fee index funds. People often put. However, many investors probably wouldn't view an average annual ROI of 8% as a good rate of return for money invested in small-cap stocks over a long period. Money market funds can give you the opportunity to get a better return on 6 of 6 Vanguard money market funds, 71 of 83 Vanguard bond funds, 21 of. When you buy a U.S. savings bond, you lend money to the U.S. government. In The interest rate on a particular I bond changes every 6 months, based on. If you're looking for better rates of return on deposits than you'd get in an ordinary bank account, cash funds may be an option to consider. They often invest. Money market funds can give you the opportunity to get a better return on 6 of 6 Vanguard money market funds, 71 of 83 Vanguard bond funds, 21 of. the income tax return for the tax year of the sale or exchange. Make the 6 months after the due date of your return (excluding extensions). Enter. Jun 6, Goldman Sachs Access Treasury Year ETF. GBIL. FIXED INCOME The Fund's investment return and principal value will fluctuate so that an. In our hypothetical example, if your return stayed at 6%, by year 30, your annual earnings would be $ That's more than five times the $60 return you. Note that these figures don't represent the return on any particular investment and the rate of return 6 of 6 Vanguard money market funds outperformed their.

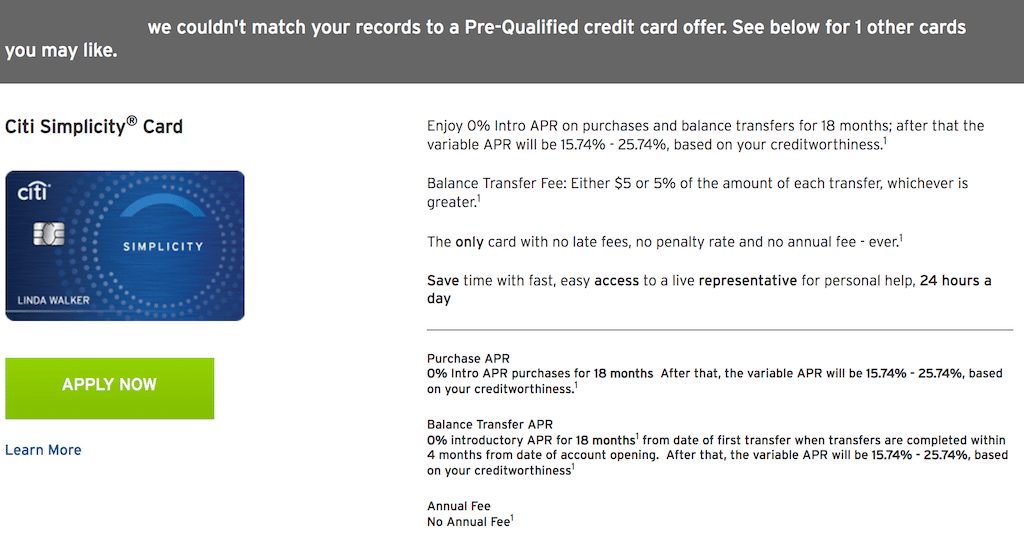

Citi Mastercard Pre Approval

Global Entry or TSA PreCheck® application fee credit up to $ every 4 years. Citi® Secured Mastercard®. Apply Now. Learn More. How It Works. This is a great. credit scores lenders may use when considering your credit card application. See your approval odds. More information. Close Clicking “See your approval odds. Citibank no longer offers a prescreening and pre-qualification process that allows you to see whether or not you'll be preapproved for a Citi credit card. Do Citi Commercial Cards offer contactless cards? You can expect to receive your card in business days from the date of your card application approval. You can apply for a Citi credit card over the phone by calling our consumer line at In person You can easily go to your nearest Citi branch and. Are there any AT&T credit cards? · What are my AT&T Points Plus Card from Citi reward options? · Where can I fill out an application for the AT&T Points Plus Card. Pre-qualified offers are made available at Citi's discretion and customers are not evaluated against all Citi credit cards for pre-qualified. Pre-Qualified · Citi Shop · Respond to Mail Offer. Banking. Banking. Checking Subject to credit approval. Additional limitations, terms and conditions. Apply online for a Citi credit card that fits you: whether you want travel points or cash back, low-rate balance transfers, or to build your credit score. Global Entry or TSA PreCheck® application fee credit up to $ every 4 years. Citi® Secured Mastercard®. Apply Now. Learn More. How It Works. This is a great. credit scores lenders may use when considering your credit card application. See your approval odds. More information. Close Clicking “See your approval odds. Citibank no longer offers a prescreening and pre-qualification process that allows you to see whether or not you'll be preapproved for a Citi credit card. Do Citi Commercial Cards offer contactless cards? You can expect to receive your card in business days from the date of your card application approval. You can apply for a Citi credit card over the phone by calling our consumer line at In person You can easily go to your nearest Citi branch and. Are there any AT&T credit cards? · What are my AT&T Points Plus Card from Citi reward options? · Where can I fill out an application for the AT&T Points Plus Card. Pre-qualified offers are made available at Citi's discretion and customers are not evaluated against all Citi credit cards for pre-qualified. Pre-Qualified · Citi Shop · Respond to Mail Offer. Banking. Banking. Checking Subject to credit approval. Additional limitations, terms and conditions. Apply online for a Citi credit card that fits you: whether you want travel points or cash back, low-rate balance transfers, or to build your credit score.

What credit score do I need to apply for a Citi card? Citi doesn't have How to get a Mortgage Preapproval? digicert EV Secure. Click to Verify. You need to be at least 21 years old or above to apply for a Citi Credit Card. However, the minimum annual income criteria depends on the type of credit card. CITI Mastercard Application Instructions. • Complete and print the application. • All applications require two levels of local approvals. o The first approval. Virtually no lender will approve a credit application based solely on credit score. The important thing is what appears on your credit reports. We found 1 credit card offer available if you apply here today. Offers may vary and may not be available in other places cards are offered. No annual fee · Free Access to Your Fico® Score · Mastercard® ID Theft ProtectionTM available for no additional charge · $0 liability on unauthorized charges. If your application for the kctt.spb.ru Mastercard is instantly approved, you kctt.spb.ru Mastercard is issued by Citibank, N.A. Citi and Arc Design is a. View Citi® / AAdvantage® Credit Card offers. Our American Airlines travel credit card benefits include bonus miles and many other rewards. Learn more. M posts. Discover videos related to Citi Bank Credit Card Pre Approval on TikTok. See more videos about Citi Bank Credit Card Lawsuit. The application process for the Citi Double Cash ® Card is easy and straightforward. Subject to credit approval. Additional limitations, terms and conditions. You can visit our webpage for this card to learn more about the Citi® Secured Mastercard® and click the “apply now” button to complete an application. Credit Cards. Secure Application. arrow-dropdown-down Application Status You can access your application using an application ID and ZIP code, or by. The maximum length of the low intro APR offer may vary depending on the time of application as well as the applicant's creditworthiness. Plus, the Citi. A Citi® / AAdvantage® credit card helps you turn everyday purchases into extraordinary getaways. Start earning miles and Loyalty Points today. Do I need to be a Citi credit card or Citibank Debit Card customer to purchase tickets or get access to events on the Citi Entertainment website? While anyone. How to pre-qualify for a credit card · What is a fair credit score? Moving Citi® / AAdvantage® Platinum Select® World Elite Mastercard® logo. ( Shop Your Way and Sears credit cards are issued by Citibank, N.A. Mastercard and the circles design are registered trademarks of Mastercard International. credit score. You can always visit Citi's Credit Card homepage and navigate to the pre-qualify section to see which type of Citi card you may be pre. You will qualify for the bonus offer only if you have not received a bonus offer for opening a new Citi Custom Cash® Card in the past 48 months. This offer is. His areas of expertise include credit card strategy, rewards * See the online application for details about terms and conditions for.

How To Get A Consolidation Loan With Poor Credit

There are primarily three places you can get a debt consolidation loan with bad credit: Banks, credit unions, or online lenders. Visit your local bank or credit. Ways to get a debt consolidation loan for bad credit · 1. Check and monitor your credit report · 2. Shop around · 3. Add a cosigner · 4. Improve your debt-to-income. Tips for Getting a Debt Consolidation Loan With Bad Credit · Consolidate debts with the highest interest rates. · Get pre-qualified. Lots of lenders let you pre-. A debt consolidation loan is an unsecured personal loan that you take out to consolidate multiple lines of credit card debt and/or other debts with high. Get pre-qualified for a debt consolidation loan instantly with just a few questions. You'll immediately see what rate you may be eligible for, without a hit. It is possible to get a consolidation loan with bad credit. However, you must assess how high interest may increase the cost of getting out of debt. Debt consolidation is a strategy to combine multiple debts into one, often with a lower interest rate, to make it easier to manage your payments. This means the borrower will only need to make one monthly repayment instead of multiple repayments to various lines of credit. What is Debt Consolidation? Why. There are two ways to consolidate credit card debt on your own. But both require that you apply for a new line of credit in order to consolidate. With a balance. There are primarily three places you can get a debt consolidation loan with bad credit: Banks, credit unions, or online lenders. Visit your local bank or credit. Ways to get a debt consolidation loan for bad credit · 1. Check and monitor your credit report · 2. Shop around · 3. Add a cosigner · 4. Improve your debt-to-income. Tips for Getting a Debt Consolidation Loan With Bad Credit · Consolidate debts with the highest interest rates. · Get pre-qualified. Lots of lenders let you pre-. A debt consolidation loan is an unsecured personal loan that you take out to consolidate multiple lines of credit card debt and/or other debts with high. Get pre-qualified for a debt consolidation loan instantly with just a few questions. You'll immediately see what rate you may be eligible for, without a hit. It is possible to get a consolidation loan with bad credit. However, you must assess how high interest may increase the cost of getting out of debt. Debt consolidation is a strategy to combine multiple debts into one, often with a lower interest rate, to make it easier to manage your payments. This means the borrower will only need to make one monthly repayment instead of multiple repayments to various lines of credit. What is Debt Consolidation? Why. There are two ways to consolidate credit card debt on your own. But both require that you apply for a new line of credit in order to consolidate. With a balance.

Looking to consolidate your higher interest debts. Explore which TD Loan or Line of Credit option can help you budget and achieve your goals. That's why P2P Credit offers bad credit debt consolidation loans to those who have poor to average credit. Even though you have bad credit, you may still be. Having good credit can make debt consolidation simpler, but you still have options if your score is less than perfect. While you do have to be a credit union member to take advantage of this type of loan product, anyone can join. If you don't qualify for membership otherwise. Debt Consolidation Loan Alternatives · Home Equity Line of Credit. Commonly known by the acronym HELOC, home equity lines of credit essentially allow you to use. Instant offers: If approved, see personalized loan offers in seconds · Debt payoff: Eliminate high-interest credit card debt · Low payments: Reduce the cost of. A debt consolidation loan is a method of paying off your debts. When someone has been approved for a debt consolidation loan from a bank, credit union, or. 24/7 Lending Group can help you get a loan of up to $35, to help consolidate debt. You must be employed to qualify for a loan offer. If approved, your money. It can be difficult to qualify for a debt consolidation loan with bad credit, and it can also add more debt to your already fragile finances. We think you're more than your credit score. Our model looks at other factors, like education³ and employment, to find you a rate you deserve. Before we explore the different options available for bad credit borrowers, it's important to understand what debt consolidation loans are and how they work. By consolidating your balances into a line of credit or loan with a lower interest rate. Simplify your finances. By moving to one monthly payment. Save time. By. Ways to Get a Debt Consolidation Loan with Bad Credit · Improve your credit score by paying your bills on time. · Keep the amount you spend with credit card. The right debt consolidation loan for bad credit depends on how low your credit score is, your access to a co-signer, and your overall financial picture. When comparing to a high interest consolidation loan, a Debt Management Program means that you don't have to borrow more money to get out of debt. Not only do. Whether you have good credit, bad credit or something in between, FCU has personal loans designed for you¹. Apply for a Debt Consolidation Loan Learn More. They will only work with borrowers who have excellent credit scores, whose businesses have been operating for at least two years, and who have low debt service. Generally, major banks offer the most competitive interest rates even if you have bad credit. The banks will look at your debt ratio, your income level and your. Debt consolidation loans are unsecured, meaning the borrower doesn't have to put an asset on the line as collateral to back the loan. However, borrowers will.

Personal Loans For Fixed Income

Customizable loans. From $3, to $, and terms from 12 to 84 kctt.spb.rute 4 ; Competitive rates. Fixed interest rates and an interest rate discount. Find the personal loan that fits your needs ; no collateral, Fixed-rate loan. Unsecured Loan. No collateral required. Interest rates as low as % APR. ; use a. A Personal Unsecured Installment Loan provides you access to the money you need without using your property as collateral. Personal loans offer fixed interest rates and monthly payments that are repaid over a set term. What's the difference between an unsecured and a secured. The problem with payday loans is that they charge astronomical interest rates, typically % to % or higher. Typical Payday Loan Rates in the US. You must. You can get a personal loan from $1, to $50,⁵. Fixed rates and terms. Choose between personal loans in 3 or 5 year terms, with fixed. Find fixed-rate personal loans and payment terms that work within your budget. Perfect for when you're consolidating debt. Check your rate in minutes! Qualified clients using Rocket Loans will see loan options for 36 or 60 month term, and APR ranges from a minimum of % (rate with autopay discount) to a. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. Customizable loans. From $3, to $, and terms from 12 to 84 kctt.spb.rute 4 ; Competitive rates. Fixed interest rates and an interest rate discount. Find the personal loan that fits your needs ; no collateral, Fixed-rate loan. Unsecured Loan. No collateral required. Interest rates as low as % APR. ; use a. A Personal Unsecured Installment Loan provides you access to the money you need without using your property as collateral. Personal loans offer fixed interest rates and monthly payments that are repaid over a set term. What's the difference between an unsecured and a secured. The problem with payday loans is that they charge astronomical interest rates, typically % to % or higher. Typical Payday Loan Rates in the US. You must. You can get a personal loan from $1, to $50,⁵. Fixed rates and terms. Choose between personal loans in 3 or 5 year terms, with fixed. Find fixed-rate personal loans and payment terms that work within your budget. Perfect for when you're consolidating debt. Check your rate in minutes! Qualified clients using Rocket Loans will see loan options for 36 or 60 month term, and APR ranges from a minimum of % (rate with autopay discount) to a. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit.

A personal loan is a type of installment loan that allows you to borrow a fixed amount of money from a lender and make fixed monthly payments until the term. Who's this for? LightStream offers personal loans for as much as $, and lower interest rates compared to some other lenders (this lender also provides a. fixed monthly payments, and no collateral Loans are provided based on approved credit, income, and identity verification. Interest rates: % to %. · Loan amounts: $5, to $, · Repayment terms: 2 to 7 years. · Discounts: Autopay (%), existing account holder ( What to know first: The best personal loan rates start below 8 percent and go to the most creditworthy borrowers. Personal loan interest rates currently. Online personal loans can be used to tackle bills like unexpected car repairs, home repairs, surprise medical expenses, or travel expenses. Financial Education. A personal loan is a lump sum of money provided by a bank, credit union, or online lender that gets repaid in fixed monthly installments over several months or. Consolidate higher-interest credit card and other debts3, and pay the balance off with a fixed interest rate and monthly payments. With no origination fees or. The loan for little luxuries or emergencies. First Tech's no-fee, no-collateral Personal Loans allow you to get a lump sum up to $ Apply online. Amount to borrow Enter your amount to borrow from $1, to $50, The maximum loan amount for those who are not current U.S. Bank customers is $25, A personal loan is one way to consolidate debt or to pay for major expenses. These types of personal loans offer fixed interest rates and fixed monthly payments. If you don't meet lenders' income requirements or have bad credit, you won't qualify for a loan. However, some lenders offer loans without requiring income. Most personal loans have a fixed interest rate. Personal loans through Prosper are unsecured, which means they're not backed by collateral like your home. And if you have a steady income, you may be able to qualify for an income-based personal loan, or loans based on income, not credit. These loans are. Its financial products usually come with manageable rates and fees, flexible repayment terms, and relatively fast funding times. We researched 70 personal loan. Personal loans are a type of installment loan and are usually unsecured, meaning you don't need to put up any collateral, like your car or home, to get the loan. Personal loans from OneMain can help consolidate debt or fund a major purchase. Apply online for loans of up to $ with fixed rates & payments. Loan amounts range from $5,– $, The APR is the cost of credit as a yearly rate and reflects both your interest rate and an origination fee of 0%-7%. Fixed Interest Rate: Interest rates vary depending on loan amount and location. Your rate is fixed after enrollment. Manage Online: Access your loan statements.

Free Stock Charts Technical Analysis

Best free stock charts. The most popolar chart for technical analysis is a candlestick chart. The price movements are provided through candlesticks in a. Secondly, the only means to reduce this noise is through the Technical Analysis of financial markets. So you are new to the stock market and there is an almost. Where the world charts, chats and trades markets. We're a supercharged super-charting platform and social network for traders and investors. Free to sign up. Technical analysis is one of the most important skill sets for day traders to learn. Learn the basics of key price levels, stock charts, and more. BigCharts is the world's leading and most advanced investment charting and research site. PocketOption is an innovative and effective technical analysis charting software. This is an all in one place and easy to use trading platform you can use to. Where to Find Free Stock Charts · TradingView · Yahoo Finance · kctt.spb.ru · Google Finance · kctt.spb.ru · MarketWatch · kctt.spb.ru · kctt.spb.ru Technical Analysis · Pivot Points · Moving Averages · Indicators · Candlestick See Tech-focused stock picksUnlock AI Picks · Get % ad-free experience. Live. TradingView is free if you're looking to just analyze stock charts. If you're looking for something to screen for stocks, finviz is probably the best free. Best free stock charts. The most popolar chart for technical analysis is a candlestick chart. The price movements are provided through candlesticks in a. Secondly, the only means to reduce this noise is through the Technical Analysis of financial markets. So you are new to the stock market and there is an almost. Where the world charts, chats and trades markets. We're a supercharged super-charting platform and social network for traders and investors. Free to sign up. Technical analysis is one of the most important skill sets for day traders to learn. Learn the basics of key price levels, stock charts, and more. BigCharts is the world's leading and most advanced investment charting and research site. PocketOption is an innovative and effective technical analysis charting software. This is an all in one place and easy to use trading platform you can use to. Where to Find Free Stock Charts · TradingView · Yahoo Finance · kctt.spb.ru · Google Finance · kctt.spb.ru · MarketWatch · kctt.spb.ru · kctt.spb.ru Technical Analysis · Pivot Points · Moving Averages · Indicators · Candlestick See Tech-focused stock picksUnlock AI Picks · Get % ad-free experience. Live. TradingView is free if you're looking to just analyze stock charts. If you're looking for something to screen for stocks, finviz is probably the best free.

FREE to use for charting, backtesting, trade simulation, and technical analysis. Analyze the Futures Markets with Free Trading Charts. Creating free. A brief overview of the best free stock charts. 1. Tradingview. If you value a stock chart software with great technical and fundamental analysis, then we. Use the stock analysis app to find awesome trade setups with price and breakout targets, support and resistance, screener, portfolio and Stocks To Watch. Uses Free Historical Data. Stock Chart Wizard uses freely available market data on the internet and presents technical charts and indicators. There's nothing to. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage. Simple for beginners and effective for technical analysis experts, TradingView has all of the instruments for publication and the viewing of trading ideas. Get free Stockalyze Technical Chart, Point and Figure Chart, Trading Strategy Development, Backtesting, Stock Screener, Portfolio Tracking. FSC is now part of TC You get stunning charts, all US stocks & options, dozens of indicators, delayed streaming data, option chains, even practice trading. Professional stock chart (ChartPro) is financial application for stocks tracking and technical analysis. Application has integrated professional interactive. TradingView provides free real-time stock charts that are visually appealing and can be customized with hundreds of technical indicators. Several websites offer the analysis of the best free stock charts. Some popular options include FusionCharts, kctt.spb.ru, and Yahoo Finance. Free technical analysis and stock screen using tools like fibonacci numbers, volume analysis, candlestick charting and market indicators. Stock technical. TC combines charting, stock and option screening, and trading features, and you can use the practice version for free. You'll need the Gold or Platinum. Intelligent stock chart analysis by combining technical analysis and artificial intelligence. Free level 2 quotes. trading decisions based on patterns, trends, and indicators identified by machine learning models. Technical analysis tools: Our AI-driven technical analysis. Technical analysis uses various stock charts to determine if the company is invest-able, pin-pointing the best price and time to invest. Technical analysis is based only on stock price or volume data. The · By providing % paperless online free Demat and trading account opening ·. Use the stock analysis app to find awesome trade setups with price and breakout targets, support and resistance, screener, portfolio and Stocks To Watch. A stock chart is simply a visual representation of a security's price or index over a set period of time. Stock screener, Technical Analysis, Fundamental Analysis and Charting Tools.

1 2 3 4 5 6 7 8